👋 Welcome back to "AI Simplified for Leaders," your weekly digest aimed at making sense of artificial intelligence for business leaders, board members, and investors. I invite you to explore the past issues here.

This week, I first delve into AI news including the NVidia AI conference GTC, Microsoft’s new head of AI, and Sam Altman’s 2-hour interview. Then I discuss the investment tech landscape and AI’s impact. Furthering the topic from the boards’ perspective, I provide a list of questions board trustees can ask their investment advisers. Finally, as usual, I end with some practical day-to-day AI suggestions. Enjoy.

Notable AI News, Curated for You

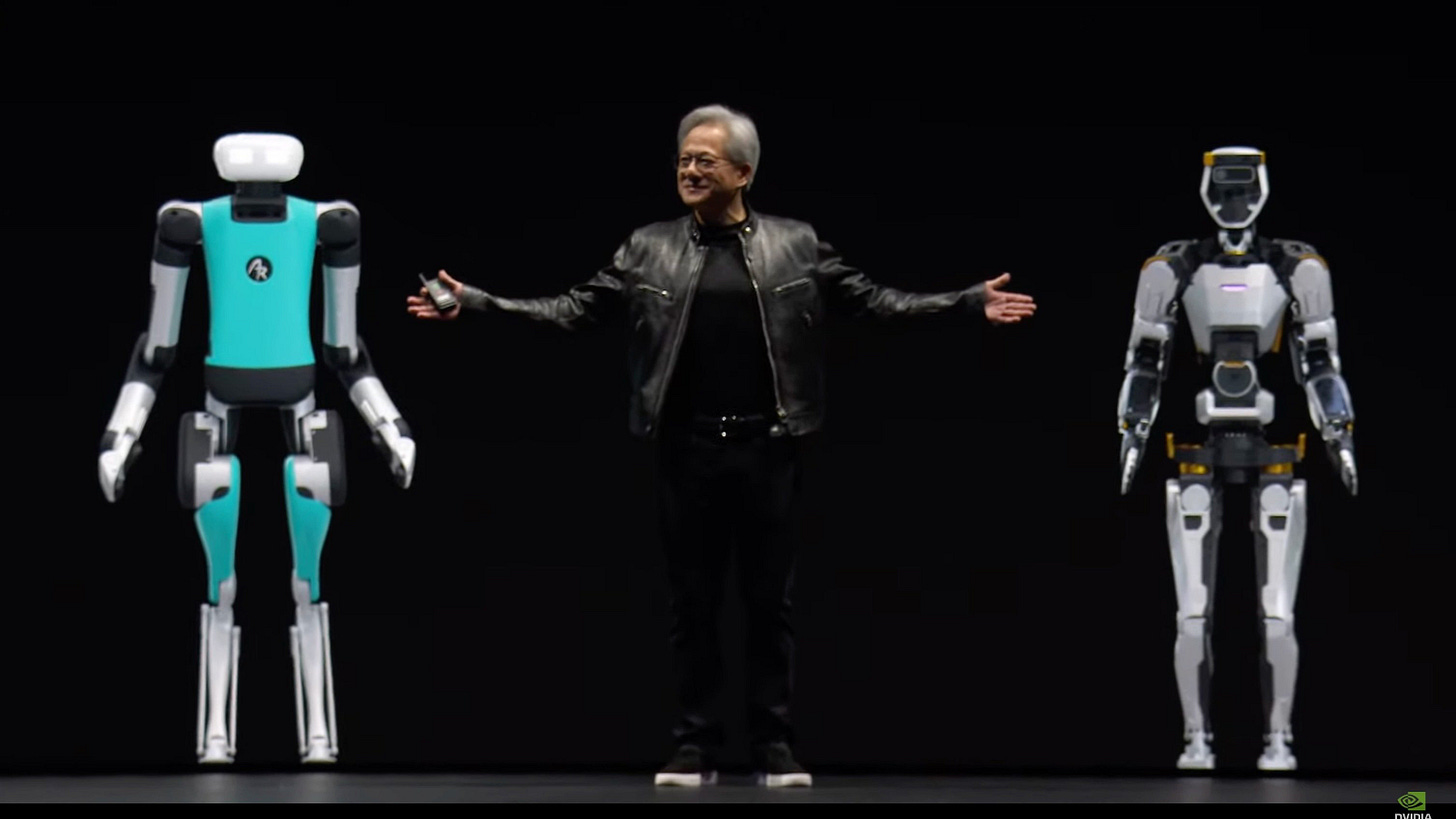

1. NVidia GTC Wrap: Expanding Lead, Software, Robotic Future

Nvidia's annual event has evolved dramatically from its origins as a niche gathering for hardware engineers and tech aficionados into an electrifying showcase resembling the Super Bowl, but for AI enthusiasts. Propelled by the AI gold rush's lucrative momentum, Nvidia is leveraging its substantial cash flow to outmaneuver competitors, further cementing its dominant position in the industry. My takeaways:

Technological Leadership with Blackwell: Nvidia's introduction of the Blackwell AI chip platform marks a significant leap forward. However, we probably will see some concerns regarding availability and pricing, especially given the ongoing shortage of previous-generation chips.

Strategic Expansion into Software: Nvidia is launching a software platform designed to streamline AI model deployment. This move towards recurring software license revenue heralds a positive shift for Nvidia's business model, promising long-term benefits.

The Dawn of Gr00t: The early-stage unveiling of Gr00t, a general-purpose foundation model for humanoid robots, highlights Nvidia's ambition to lead in the next frontier of AI. Given its financial standing and deep talent pool, its advantage in spearheading this technological evolution is unmistakably clear.

You can watch NVidia CEO Jensen’s keynote here. Just in case you are paying attention to this sort of things too: Jensen’s leather jacket was fancier than usual.

2. Microsoft Appointed Inflection AI’s Founder as Head of AI

Mustafa Suleyman, the co-founder of Inflection AI and previously a co-founder of Google DeepMind, has been appointed to lead a new division at Microsoft called Microsoft AI. This division will focus on consumer AI products and research, including Copilot, Bing, and Edge. Suleyman, along with Inflection AI's Chief Scientist Karén Simonyan and several others from the startup, will join Microsoft.

The appointment is significant and surprising for a few reasons:

Suleyman's background as an AI visionary and responsible AI proponent, and his track record of innovation and leadership in consumer AI are expected to drive Microsoft's consumer AI initiatives forward;

It raises questions about Microsoft's ongoing relationship with OpenAI. Is Microsoft hedging its bets on two frontrunners simultaneously, thereby intensifying competition in the sector?

Inflection AI has raised $1.3bn in funding and developed the first personal AI chatbot Pi, with Microsoft being a major investor. Surprisingly, even with key talent departures, Inflection AI will continue its operations and pivot to creating customized AI models for businesses.

Notably, Microsoft orchestrated this strategic move without opting for an outright acquisition of Inflection AI. Instead, it has agreed to pay an additional $650 million to Inflection AI, predominantly in the form of guaranteed license fees, to offer Inflection AI’s products on its Azure services.

This maneuver further illustrates Microsoft CEO Satya Nadella’s knack for attracting top AI talent and convincing the board to support innovative strategies, marking another significant move in Microsoft's AI journey.

3. OpenAI CEO Sam Altman’s 2-Hour Interview by Lex Fridman

In this interview, my high expectations clashed with reality, resulting in a somewhat underwhelming experience. Fridman appeared less engaging than usual, which, coupled with Altman's occasional impatience with the questions or comments, dampened the dynamic between the two. Despite covering a range of trending topics—from the board saga and AGI to GPT-5, Sora, Elon Musk, and the relationship with Ilya—the conversation rarely broke new ground or offered thought-provoking insights. This was disappointing, given the usually compelling discussions I look forward to from Fridman and Altman.

For those interested, I recommend giving it a listen and forming your own opinions.

4. Some Additional Thoughts

Quiet Concentration of Power?

Microsoft and Nvidia are enhancing their dominance in their respective fields, leveraging strategic partnerships and technological advancements without significant regulatory pushback. I would love to hear your thoughts on this topic.

A Tale of Two Cities: Bay Area vs Others

I’ve traveled to different parts of the country lately. The difference in how AI is perceived and talked about in the Bay Area versus other parts of the country is quite striking. In the Bay Area, you can't escape the constant buzz around AI - it's in every conversation, every headline, and every startup pitch. There's a palpable sense of excitement and possibility, tinged with anxiety about what the future might hold. People here seem to have bought into the idea that AI is going to change everything, and they want to be at the forefront of that change.

But step outside of the Silicon Valley bubble, and the conversation around AI is much more muted. It's not that people are unaware of it, but it doesn't dominate the discourse in the same way. In boardrooms and business meetings across the country, AI is often treated as just another technology trend with a long list of potential dangers attached to it, one that may or may not prove to be transformative and relevant for their own businesses in the long run. There's a healthy dose of skepticism about the hype coming out of the Bay Area, and a recognition that adopting AI is not a straightforward process.

This disconnect is a reminder that technological progress is never evenly distributed, and that the realities on the ground can look very different from the visions being dreamed up in the world's innovation hubs. It's not a value judgment on which perspective is right or wrong, but rather an observation of the complex interplay between technology and society. As AI continues to evolve and make its way into more and more industries, it will be fascinating to see how these different viewpoints shape its development and adoption in the years to come.

How AI is changing Investment Tech

As the DiligenceVault 2024 InvestTech Ecosystem Map reveals, the industry is grappling with a highly competitive environment, characterized by high distribution costs, lengthy sales cycles, and substantial switching costs.

However, the democratization of AI is opening doors for innovative tools and in-house solutions that challenge incumbent players.

A recent AIMA research surveyed 157 hedge fund managers with an estimated US$783bn assets in aggregate. The resulting report highlights the widespread adoption of generative AI tools, with 86% allowing their use to support employees' work. Larger firms are leading the charge, leveraging popular tools to enhance marketing materials, streamline coding efforts, and bolster research and analysis. The impact of Gen AI is expected to be far-reaching, with significant disruption anticipated in research, IT, legal and compliance, and investor relations within the next two years.

One area where AI is making significant strides is in the realm of alternative and unstructured data. Traditionally, deciphering such data required substantial capital expenditure and manual labor. However, AI has democratized this process, enabling cost-effective solutions tailored to niche investment strategies. For example, AI can now efficiently leverage diverse data sources, such as government filings and business contracts, to facilitate the due diligence of physical assets as collaterals.

A company worth mentioning: although not specifically built for investment tech, Unstructured.io turns unstructured data into information and data that can be further processed by AI or other analytical tools and solves a big pain point (‘garbage in, garbage out’) in business use of data.

Moreover, the integration of Gen AI in research and document management is proving to be a game-changer. Beyond mere summarization, AI can distill information to uncover actionable insights, highlight deviations from market beliefs, and identify key questions that historically drive long-term success. This enhanced pattern recognition empowers analysts to focus on the most critical aspects of complex data sets.

AI-native solutions are also revolutionizing discovery processes and consultant databases. By providing deeper insights into the qualitative aspects of performance drivers, these tools enable more nuanced ratings and evaluations, offering a richer understanding of investment managers. An interesting company to watch here is Radient AI, an AI-powered fund intelligence platform founded by industry veterans in fund risk analytics and ETF fund boards.

While portfolio management applications of AI are currently limited, 20% of larger hedge funds anticipate substantial AI-driven changes in this domain. Early adopters are harnessing AI to create thematic stock baskets and leveraging generative adversarial networks to develop synthetic financial time series data for evaluating trading signals. The potential for AI to optimize portfolios by analyzing vast datasets is gaining recognition.

However, the path to successful AI integration is not without challenges. Data security and privacy concerns, inconsistent AI outputs, and the need for comprehensive staff training are among the key hurdles. As hedge funds strategically hire AI specialists and invest in proprietary capabilities, the gap between AI-enabled firms and laggards may widen. Smaller funds can remain competitive by leveraging open-access models and focusing on targeted use cases.

Ultimately, the successful adoption of AI in the investment industry will depend on the quality of data, the sophistication of models, and a deep understanding of financial theories and market dynamics. While AI can enhance efficiency and provide valuable insights, it is crucial to maintain a human-centered approach to decision-making, maximizing the strengths of both AI and human intelligence.

Fund Director’s Corner:

Questions You Need to Ask Your Investment Advisers on AI

The SEC recently charged two investment advisers, Delphia and Global Predictions, with making false and misleading statements about their use of AI in their investment processes. Toronto-based Delphia misrepresented its AI and machine learning capabilities in SEC filings, press releases, and on its website between 2019 and 2023. San Francisco-based Global Predictions falsely claimed on its website and social media in 2023 that it was the "first regulated AI financial advisor" and misrepresented its platform's ability to provide "expert AI-driven forecasts." Both firms settled the charges without admitting or denying the allegations.

The SEC charge underscores the importance of due diligence and oversight by registered fund board trustees when investment advisers claim to use AI technologies. Trustees should ask the following questions:

Verification of AI Capabilities: How are the actual capabilities and implementation of AI technologies claimed by investment advisers verified?

Compliance and Disclosure: What measures ensure that disclosures about AI usage are accurate and comply with regulatory requirements?

Risk Management: How are risks associated with AI technologies identified, assessed, and managed?

Oversight and Governance: What governance structures oversee the use of AI in investment processes?

Transparency and Accountability: How is transparency maintained with investors regarding AI usage, and what accountability mechanisms are in place for misleading claims?

Due Diligence on Third-Party Providers: What due diligence process was undertaken before selecting the third-party AI tool, and how is its performance and compliance with regulatory standards evaluated?

Vendor Management: What are the contractual agreements with third-party AI providers regarding responsibility for compliance, data security, and accuracy of the AI tool's functions?

Ensuring investment advisers' compliance, transparency, and responsibility in their use of AI is crucial for maintaining investor trust and safeguarding investments.

How to Learn AI

During my talks to professionals, a question often arises: "How can we learn AI to future-proof our careers?" Unlike any technological advancement we've witnessed, Generative AI stands out for its transformative potential and unparalleled accessibility. The true power of AI doesn't solely lie in the technology itself but in our hands - in our choice to engage with it as deeply or as broadly as we desire.

In response to this question, I often share three fundamental principles:

Pursue 'AI Fluency' Over 'AI Expertise'

Diving into the depths of AI technicalities or the latest research isn't a prerequisite for understanding its impact. The essence lies in experiential learning - using AI tools and observing their application. This approach fosters a practical understanding, empowering you to integrate AI into your workflows and decision-making processes effectively.

Leverage Your Unique Strengths: Ask 'Why'

In a business environment increasingly influenced by AI, your distinct advantage lies in your deep understanding of business strategy and customer needs. Instead of passively learning from technical experts about potential automation, question the rationale behind existing workflows. Is there a way to redesign these processes leveraging AI, thus achieving business objectives more efficiently? Your insights and strategic thinking are invaluable in this context.

Rethink Work Through 'Tasks' and 'Responsibilities'

The inevitability of AI reshaping the workplace calls for a shift in perspective - from defining roles by job titles to focusing on tasks and responsibilities. This mindset enables you to envision creative ways to incorporate AI into your daily activities, making your role more meaningful and enjoyable.

If you still need some guidance, here is a video for you:

In a compelling discussion, Azeem Azhar, curator of the Exponential View, converses with Ethan Mollick, a Wharton Professor and AI aficionado, on their practical experiences with AI, its adoption in organizations, and more. Their insights might spark ideas for you.

Thank you for reading. Enjoy your Spring.

Joyce Li