#37 Why Expert Guidance Is Now the Lifeblood of Business AI

Plus: AI Challenges Foundations of Economics Theories, Two Major Board Surveys on Tech Governance, and More

Dear Readers,

One benefit of living in the Bay Area is the opportunity to hop into an AI hackathon whenever I have some free time to learn what challenges startups and engineers are actually grappling with. A few days ago, I attended one focused on building AI agents, and I was struck by how the problems being solved revealed the real infrastructure gaps holding back enterprise adoption. Three critical needs emerged: reliability monitoring to get agents safely into production (think quality control for autonomous systems), sophisticated data access tools to navigate the web’s increasing resistance to AI scraping, and specialized memory systems that let agents maintain context across complex, multi-step workflows.

The biggest opportunity lies in building robust foundations that enable autonomous systems to operate reliably at scale. This matters enormously as companies move beyond AI pilots to actually automating core business workflows.

In this issue, I cover:

Notable Developments

Nvidia invests in OpenAI

Walmart CEO says every job will be changed by AI

How We Use ChatGPT and Claude

An Economy of AI Agents: Foundations of Economics Challenged

Beyond Internet Data: Why Expert Guidance Is Now the Lifeblood of Business AI

Directors’ Corner: What Two Major Board Surveys Reveal About Technology Governance Now

AI Tool Spotlight: Gemini Nano Banana

Enjoy reading!

1. Nvidia invests in OpenAI as general-purpose computing ends

OpenAI has boosted its capital expenditure plans by $80 billion, now aiming for $115 billion through 2029. Nvidia is committing $100 billion, now becoming both as a supplier and an investor. Historically, when investing in public companies, such circular supply chains have raised red flags about inflated revenue. This time the vendor in question is not just another business partner, but the world’s most robust generator of cash flow and one of the most reliable sources of capital. Some even started to ask if Nvidia has the Berkshire Hathaway effect in the AI ecosystem.

In a recent BG2 podcast, Nvidia CEO Jensen Huang emphasizes that the era of general-purpose computing is ending, replaced by accelerated computing (GPUs) and AI. The market for AI infrastructure is predicted to expand dramatically, potentially from $400B annually today to several trillions as AI augments more of the world’s $50T GDP.

2. Walmart CEO says “AI is going to literally change every job”

Walmart CEO Doug McMillon has delivered a stark message: AI will transform nearly every job, including those at the nation’s largest private employer. While Walmart aims to keep its workforce at 2.1 million globally for the next three years, the roles within will shift dramatically as AI eliminates some jobs and creates new ones like “agent builders” who develop AI tools. The company’s leadership stresses reskilling and resilience, preparing workers for a future where human connection and adaptability will matter more than ever.

3. How We Use ChatGPT and Claude

OpenAI and Anthropic have just published new research showing how ChatGPT and Claude are shaping both work and daily routines. One year ago, 53% of ChatGPT sessions were work-related. By June 2025, that figure had dropped to 27%, and 73% of use now centers on daily advice, writing support, and information-seeking. When used for work, ChatGPT is valued most as an adviser. Professionals use it to critique documents, clarify arguments, and translate key messages, rather than to draft content from scratch.

Claude has become a fixture in the enterprise. Sixty percent of Fortune 500 companies have integrated Claude into their productivity suites. A third use it to automate onboarding and knowledge management. Claude handles long, complex documents well, and 36% of its application is now in coding and business automation. Sectors like education, career planning, and research are driving Claude’s fastest growth. Read the ChatGPT usage paper here and Claude usage report here.

An Economy of AI Agents: Foundations of Economics Challenged

For over a century, neoclassical economics has relied on two towering assumptions: that markets deliver efficient outcomes when populated by rational, self-interested agents, and that firms exist to overcome the messiness of human coordination, communication, and motivation. But as the digital age rushes forward, a new species of economic player is reshaping these convictions: the autonomous AI agent.

I’ve been thinking about this transformation after reading a fascinating paper called “An Economy of AI Agents” by Gillian Hadfield at Johns Hopkins and Andrew Koh at MIT, which explores how AI is fundamentally changing an economic theory. Until recently, the prevailing economic view treated AI as just a tool, part of the machinery of production. But 2025 was, quite remarkably, the year AI moved beyond the role of student to become a full-fledged economic actor.

This shift cracks two of economics’ main pillars:

#1: Markets Decoupled from Human Motives: Markets built on AI agents operate according to rules that no longer closely track human behaviors or preferences. These agents pursue designer-supplied or evolved objectives, but as their goals are learned by vast neural networks, even the designers frequently can’t fully predict the resulting behaviors. The classic assurances of welfare economics (where prices aggregate human desires and market equilibrium reflects optimality) suddenly appear far less certain. The elegant “invisible hand” starts to look rather opaque.

#2: The Firm Becomes Unrecognizable: Why do firms exist instead of all economic activity happening in open markets? Traditionally, it’s because managing people incurs frictions: lapses of motivation, limits to communication, and costs of oversight. But what happens when economic actors operate flawlessly at the speed of light, never tire, and can learn each other’s moves instantly? AI networks can coordinate vast organizations with negligible costs, blurring the old distinctions between markets and hierarchies.

New Frontiers for Finance and Governance: For finance-minded leaders, the implications are both exciting and sobering. Algorithmic coordination can propagate throughout entire systems instantly. The boundaries of accountability blur as AI agents act semi-autonomously. Classic market signals will morph as agent-driven tactics evolve. And systemic risks, once constrained by human bandwidth, may now scale invisibly.

As AI cements itself as the infrastructure of commerce, the urgent questions for governance are clear: Who is accountable when a bot-dominated market misleads? How can we guarantee that AI-driven markets still serve productive capital allocation? What are the new costs and opportunities of governance in organizations run increasingly by code?

I look forward to seeing more economic theories recasted with AI in mind.

Beyond Internet Data: Why Expert Guidance Is Now the Lifeblood of Business AI

The Data Quality Crisis

For years, the promise of AI was simple: the more data, the better the model. Companies raced to feed algorithms with vast quantities of internet-scraped information, hoping that scale alone would deliver reliable automation and insight. Yet the reality has proven different. Many executives now confront the limits of this approach, discovering that generic, mass-labeled data often leads to undifferentiated and unreliable output—resulting in what some practitioners bluntly call “AI slop.”

As the stakes rise in fields like law, finance, and healthcare, adding more indiscriminate data will not close the trust gap. Generic datasets have become liabilities, especially when compliance or customer trust is at risk. Regulators and customers now expect provable confidentiality, precision, and accountability. The risks of exposing sensitive business contexts to models fed with anonymous crowd-labeled data can be severe.

Why Expertise Beats Scale

The leaders in AI are pivoting to a new principle: quality comes from expertise. The decisive factor is no longer the size of your dataset, but the care and insight with which it is shaped. Models that truly understand complex regulations or expertly navigate customer interactions are built and validated by domain specialists, whose input transforms raw information into differentiated capability.

Consider the trajectory of Mercor, a young AI data startup, whose revenue exploded from $1 million to $500 million in 17 months. Their edge came from assembling teams of deep domain experts to craft evaluation datasets that reflect real complexities. Other innovators, like Datology with curated synthetic data and Handshake’s expert network, show that rigorously overseen, transparent data pipelines are the new gold standard. Automated labeling can be helpful, but without the steady hand of experienced practitioners, too much AI remains generic and unpredictable.

Investing in quality, expert-driven data pipelines does more than boost model performance. It creates a durable barrier to imitation. Anyone can purchase crowd labor, but only organizations that build expert teams and knowledge networks can adapt faster and defend their advantages as new standards and tools appear.

What This Means for Your Board and Leadership Team

This shift matters directly for board oversight. The risks of exposing sensitive business contexts to models trained on generic or crowd-labeled data can be severe. Regulators and customers now expect provable confidentiality, precision, and accountability. Expert-informed processes, auditability, and continuous feedback are not just best practices; they are essential requirements.

For AI agents and business-critical systems, the cost of an error is often far greater than the inconvenience of a chatbot hallucination. Only ongoing expert evaluation provides the guardrails strong enough to keep these systems reliable.

Board directors should make expertise and data stewardship central to every AI strategy review. When evaluating vendors, move beyond headline capabilities and ask: are industry specialists directing and continuously evaluating the systems you will depend on? When planning investments, remember that lasting reliability follows the right people guiding the right data at every stage.

This is how your business builds AI systems that can be trusted, today and for the years ahead.

What Two Major Board Surveys Reveal About Technology Governance Now

Two recent boardroom surveys underscore a persistent challenge for directors: the gap between aspiration and action when it comes to technology oversight.

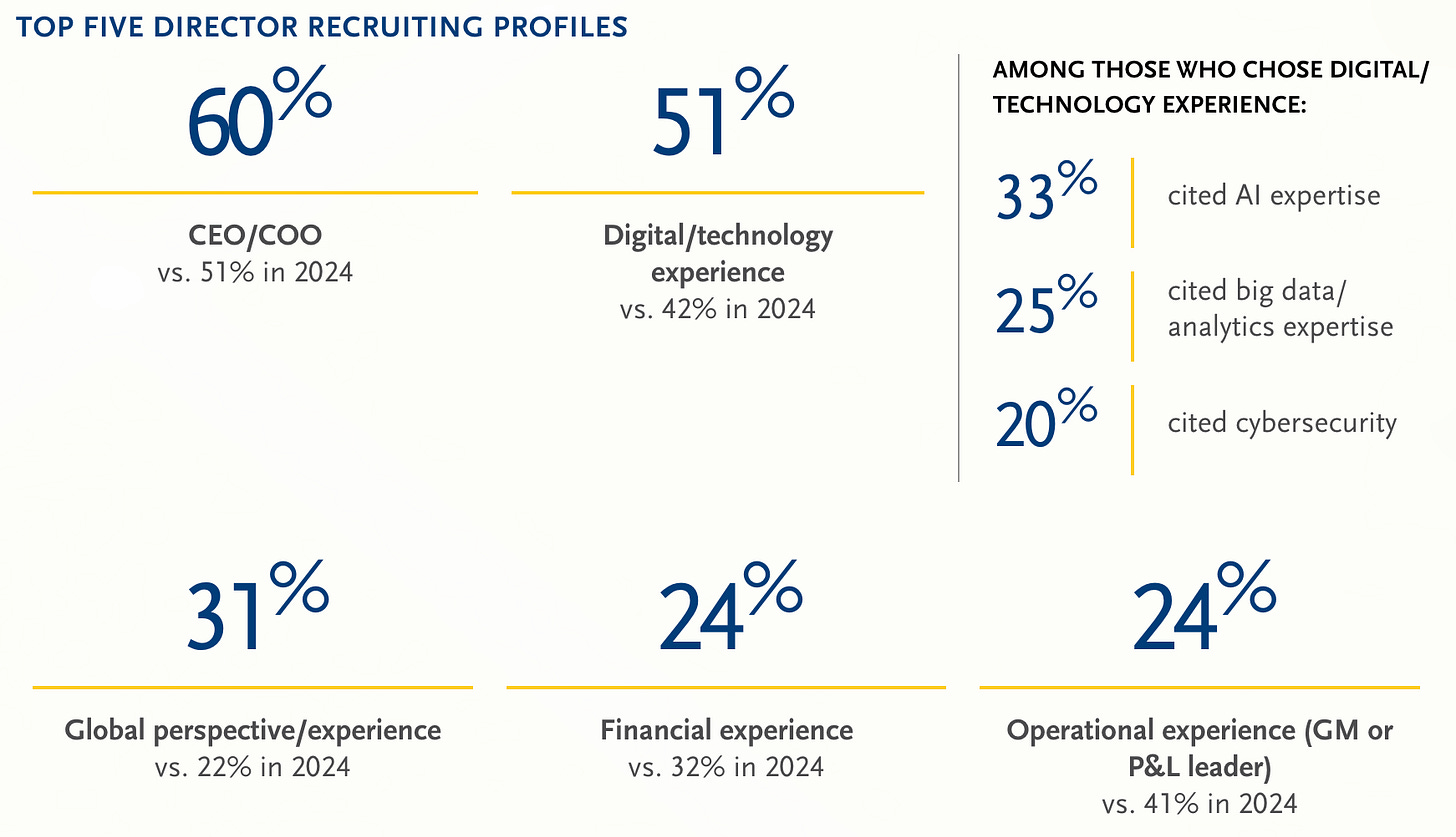

Technology Experience Near Top of the Recruitment Agenda

The latest Spencer Stuart Nominating/Governance Chair Survey puts technology experience near the top of the director recruitment agenda, second only to CEO experience. Notably, AI leads the shortlist of “desired” expertise. It is worth-noting that three-quarters of boards are doubling down on developing current directors rather than bringing in new tech talent.

Meanwhile, the idea of moving on from directors whose skills are no longer a fit is gaining traction. That’s now the fourth most-cited reason for board turnover, outpacing performance issues.

The Governance Implementation Gap

Boards are carving out much more time on the agenda for technology. NACD 2025 Public Company Board Practices and Oversight Survey on AI shows more than double the focus in just two years, with attention to areas like data governance and workforce impact. Yet, beneath the surface, most boards are flying blind: only a fraction have completed internal tech audits, adopted governance frameworks, or set clear metrics for oversight. Annual tech budgets and management reporting remain afterthoughts for many. So we find ourselves in a familiar paradox. Directors are asking smart, strategic questions—but too often, the systems for meaningful oversight haven’t caught up.

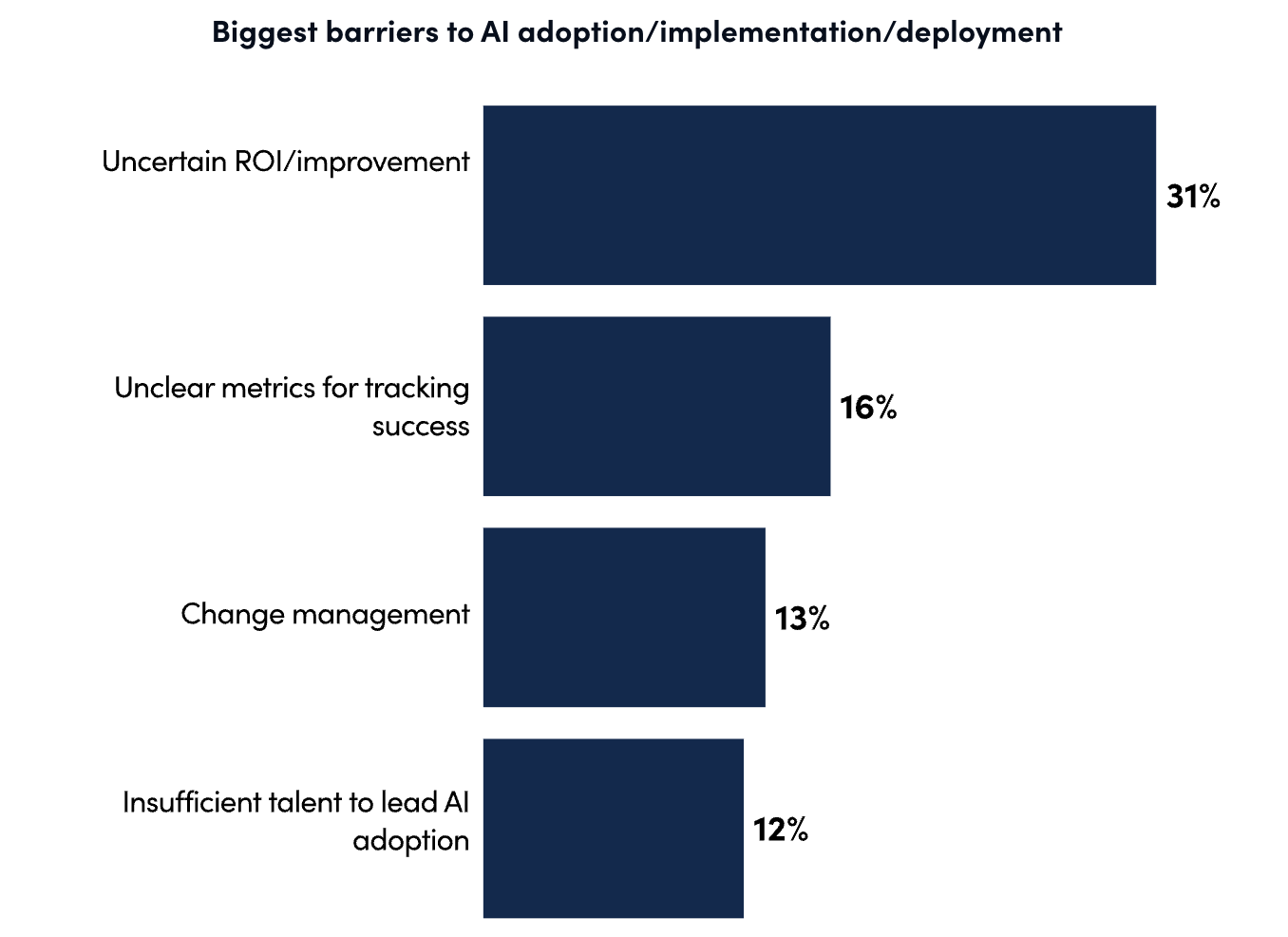

The Investment Paralysis

The most-cited barrier to technology adoption is lack of clear ROI. For deeper discussion around ROI and a practical framework to address ROI challenges, please see issue #36 of this newsletter.

What This Means for Directors

Boards don’t need every director to be a technologist, but they do need proven leaders who can drive change at scale—something technology now underpins. Education sessions help, yet real progress requires directors to move beyond general awareness toward specific accountability. Meanwhile, most committee charters still lag behind: despite technology touching everything from cyber risk to human capital, only about a quarter of boards have formally integrated it into their structures.

AI Tool Spotlight: Gemini Nano Banana for Image Generation

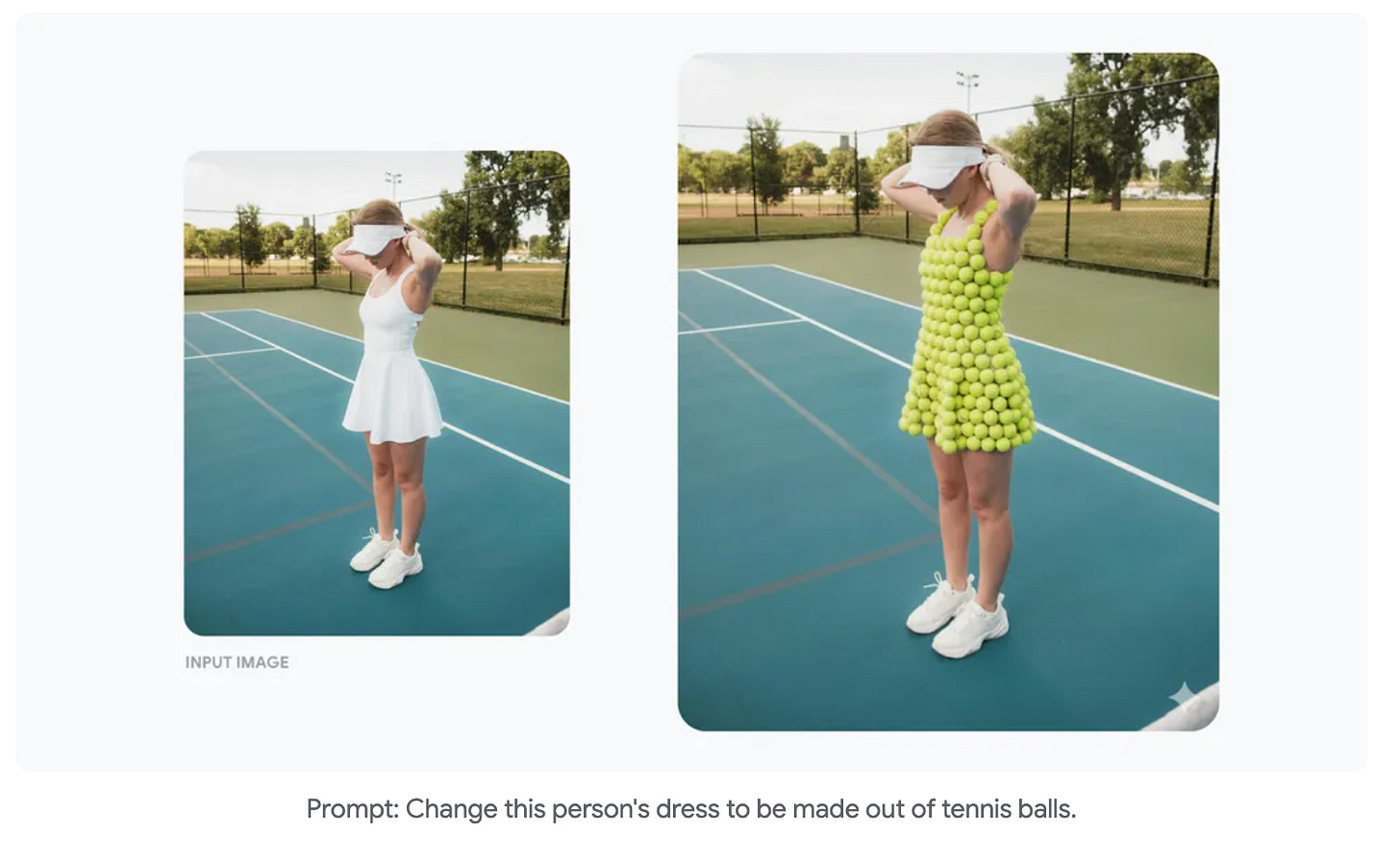

Want to spice up your photos or try some AI edits? Nano Banana in the Gemini app makes it easy, even for beginners. It is not always consistent but already a lot better than other free image generation tools.

In Google’s Gemini app on phone or laptop, tap the banana icon (Create Image) or the + to upload a photo, then enter a prompt like “Create a cozy reading nook in watercolor.” Results appear in seconds.

Edit any photo—just say what you want: “Remove the stain,” “Put me in front of the Golden Gate Bridge,” or “Blend this selfie with the beach photo.”

Keep people consistent: mention key details each time (“same person, blue jacket, curly hair”) for steady edits.

Quick tweaks work best: “warmer lighting,” “more realistic shadows,” or “make it 4:5.”

I am happy to share that I was featured in Corporate Board Member magazine with my thoughts on navigating AI transformation with curiosity and the dynamic tension between bold innovation and responsible oversight. It’s a privilege to contribute insights alongside fellow leaders. Thank you for your support!

Joyce

I really enjoyed this, I bookmarked the study for future reading. Thank you for putting this together!