#32 How to Show Up For AI Search (GEO 101)

Plus: Sub-Adviser AI Oversight on Fund Boards, Mary Meeker's AI Trends Report, and More

Dear Readers,

In this edition, I cover:

Notable Developments

How to Show Up For AI Search (GEO 101)

(Fund Board) Directors’ Corner: When It Comes to Sub-Adviser AI Oversight, Focus on What Matters

Enjoy.

Mary Meeker and BOND Capital Published 340-Page AI Trends Report

Mary Meeker's 340-page BOND report highlights AI's unprecedented growth trajectory, with user adoption and infrastructure scaling faster than any previous technology cycle. The report shows that training dataset sizes are growing at 260% annually, while inference costs have fallen 99.7% in just two years. Enterprise adoption is accelerating dramatically, with over 75% of Fortune 500 companies already using AI tools. The document argues rising competition among countries in AI represents a fundamental "space race" that will reshape global economic and political power structures over the next decade. Read full report here: BOND: Trends - Artificial Intelligence

OpenAI Acquires Jony Ive’s Design Firm

OpenAI is acquiring io, the AI hardware startup founded by Sir Jony Ive, in a $6.5 billion stock deal. Ive is a legendary British designer best known for leading the creation of Apple’s most iconic products, including the iMac, iPod, iPhone, and Apple Watch, during his decades as Apple’s chief design officer. His design vision helped define modern consumer technology and will now shape OpenAI’s next generation of AI-powered devices. The company is rumored to be developing pocket-sized, screenless, context-aware devices that act as ambient, always-on AI companions, moving beyond the smartphone paradigm.

Google I/O Product Announcements Impressed

Google I/O 2025 finally showcases a vision Google is especially well positioned for: a universal personal assistant. The centerpiece is Google’s push to make AI deeply personal and proactive, integrating across Search, Gmail, Drive, and Android to anticipate user needs and manage tasks in context. More to come in the summer. Equally impressive is Veo 3, Google’s latest AI video generator. Veo 3 can produce high-definition videos with synchronized audio.

However, traditional search revenue and regulatory scrutiny such as the risk of being forced to divest Chrome remains key uncertainties for Google’s ambitions.

Quant Group AQR Embraces AI/ML for Trading Decisions

Unlike most quant funds that use AI/ML models to make decisions for a long time, AQR has previously been hesitant about letting machines to make the decisions. Now its founder Cliff Asness said the hedge fund has “surrendered more to the machines”. The firm is willing to sacrifice some explainability of investment decisions to react faster to market changes and take advantages of trading opportunities.

An High Impact “Build over Buy” AI Use Case at Morgan Stanley

Morgan Stanley developed its own AI tool, DevGen.AI, to tackle the challenge of modernizing legacy code. This is an area where commercial AI tools have struggled, especially with outdated or highly customized languages. Launched in January 2025 and built on OpenAI’s GPT models, DevGen.AI translates legacy code (like COBOL) into plain English specifications, enabling developers to rewrite it efficiently. By training the tool on its proprietary codebase, Morgan Stanley has reviewed nine million lines of code and saved 280,000 developer hours so far.

The gate is open. Legacy banking IT systems written in COBOL may finally be brought into the modern era to embrace future AI innovations.

Fraudulent Companies Took Advantage of AI Funding Craze

Builder.ai, once valued at $1.5 billion and backed by investors like the Qatar Investment Authority, Microsoft, Iconiq Capital, Jungle Ventures, and Insight Partners, collapsed after revelations of fraud. The company had claimed to use AI to automate software development but secretly relied on human engineers in India. To attract funding, Builder.ai and Indian firm VerSe Innovation exchanged fake invoices, inflating reported sales by over 300% between 2021 and 2024.

Separately, once lauded as a model for AI-driven agricultural transformation, eFishery’s story unraveled into one of Southeast Asia’s most significant tech frauds. Despite claims of empowering hundreds of thousands of Indonesian fish and shrimp farmers, the company systematically inflated revenues by nearly $600 million, falsified profit figures, and exaggerated user numbers. Investigations revealed dual accounting books, fictitious transactions, and a long-running scheme dating back to 2018.

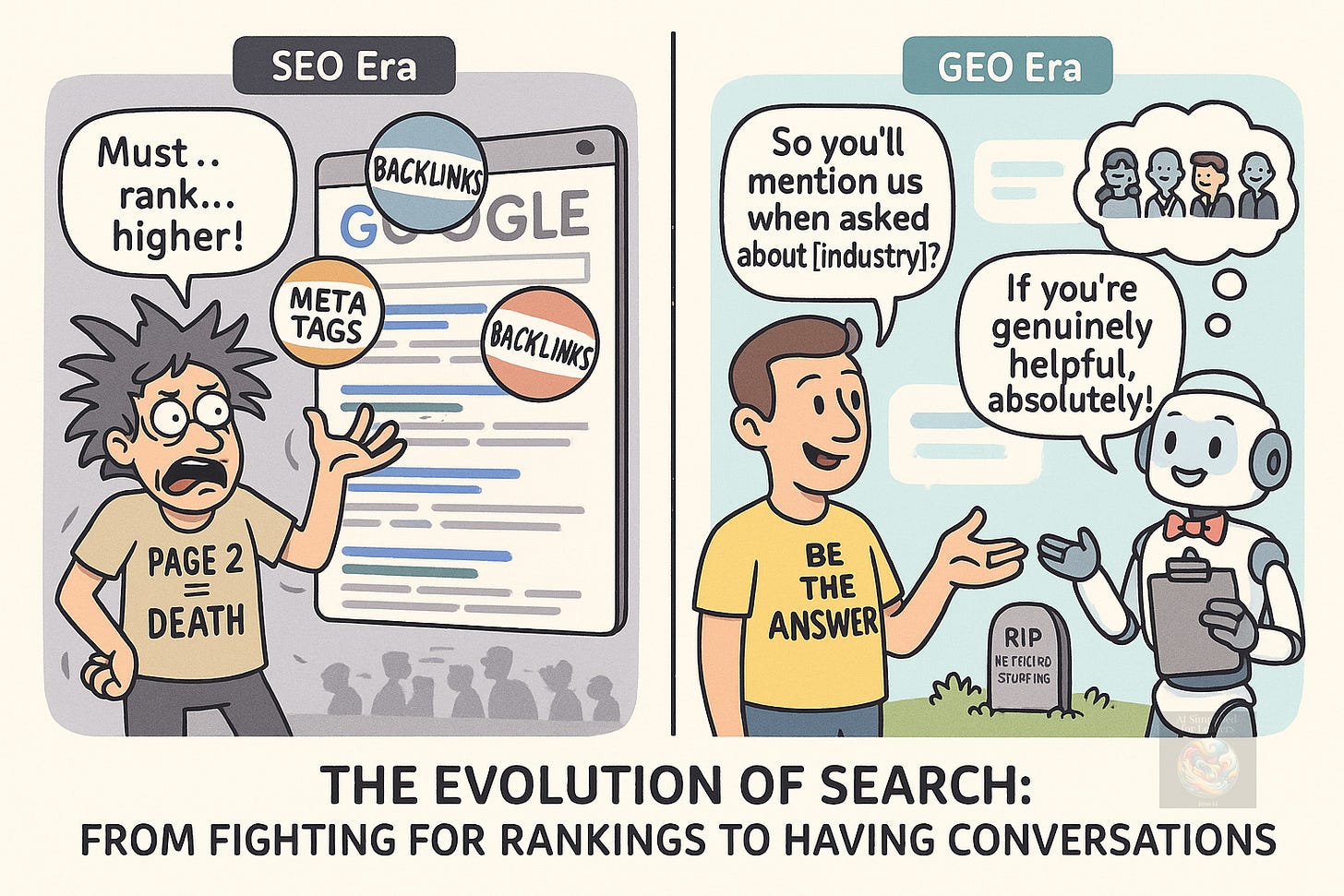

How to Show Up For AI Search (GEO 101)

Search habits are changing, is your business adapting?

Gartner recently predicts traditional search volume will drop 25% by 2026, with organic search traffic expected to decrease by over 50% by 2028 as consumers embrace AI-powered search. For businesses big or small, with the proliferation of high quality deep research capabilities, your prospects and current customers are increasingly asking AI for recommendations and comparisons.

So, when a customer asks a question about a problem that your product or service is well positioned to solve, can you make sure your company shows up in ChatGPT's answers? And if it shows up, does it show up the way you want it to?

The answer lies in what is called Generative Engine Optimization (GEO), and it's quickly becoming as critical as traditional Search Engine Optimization (SEO) was two decades ago.

Think of GEO as SEO's evolved cousin for the AI age. While traditional SEO optimizes your content for Google's search results, GEO optimizes your content so AI platforms like ChatGPT, Perplexity, Claude, and Google's AI Overviews cite and reference your business when answering user questions. As the VC firm Andreessen Horowitz puts it: "It's no longer just about click-through rates, it's about reference rates: how often your brand or content is cited or used as a source in model-generated answers."

From a finance perspective, early GEO adopters are seeing impressive returns. According to a Contently report, leading agencies report clients achieving 3-5x ROI within 6-12 months through improved AI search visibility and lead generation. One Fortune 500 financial services client saw 32% increase in AI search-attributed SQLs within six weeks, along with significant improvements in citation rates and overall AI search visibility. Such returns could moderate over time when more businesses start to pay attention.

What fascinates me is how this levels the playing field at this moment, at least before the AI companies start to monetize on the rankings. Smaller businesses could get cited more frequently than expected in AI responses, especially when they focus on specific niches or local expertise. Unlike traditional SEO that often favors big budgets and established domain authority, AI engines care about specificity, detailed expertise, and nuanced information that naturally favors focused businesses.

For business leaders curious about GEO, you can start with these practical steps:

Test your business presence (and this could apply to your personal branding too) by asking ChatGPT, Claude, or Perplexity questions your prospects would ask. Does your company get mentioned? How are you positioned relative to competitors? Understanding AI thinking patterns helps too. GEO expert Samatha North explains AI tools evaluate content using E-E-A-T principles (Experience, Expertise, Authoritativeness, and Trustworthiness) rather than just keyword matching. I also suggest setting aside time to experiment with different AI platforms and understand how they're evolving.

The good news for organizations is that much of GEO builds on solid content fundamentals. Content optimization focuses on creating conversational, high-quality content that directly answers common questions. Maybe in the not-too-distant future, your website content is written by more AI agent visitors than humans.

Authority building remains crucial by establishing your brand as a thought leader through sharing valuable insights in industry conversations and getting featured in authoritative outlets. Brand authoritativeness and thought leadership take on even greater importance with generative engines.

However, GEO metrics are harder to quantify than traditional SEO, making ROI determination more difficult. But some early movers are finding ways to track AI search attribution and building competitive advantages while the landscape is still forming.

It is early for you to claim that advantage in AI answers. And it is incredibly cost effective now because the AI engines do not monetize. As Andreessen Horowitz frames the opportunity: "In a world where AI is the front door to commerce and discovery, the question for marketers is: Will the model remember you?"

Fund Boards: When It Comes to Sub-Adviser AI Oversight, Focus on What Matters

Sub-advisers managed a substantial portion of the investment fund industry. As artificial intelligence transforms investment management, fund directors need practical frameworks for overseeing these relationships.

I recently published a piece on Fund Board Views titled "Sub-Adviser AI Oversight: Focus on what matters" that dives deeper into this evolving challenge. I encourage you to read the full article on the FBV website and share it with your fellow trustees. It includes additional case studies and practical oversight checklists that complement the overview below.

Fund boards can focus their attention on two areas where sub-advisers typically deploy AI: operational applications and investment process integration.

When AI Stays in Operations

Many investment managers use AI for operational tasks like client reporting, compliance monitoring, and trade execution. BlackRock's Aladdin Copilot helps with user onboarding and report generation, while Franklin Templeton works with Microsoft to embed AI in sales, marketing, and client support functions.

These operational changes can improve efficiency but also create some considerations for boards. When sub-advisers process fund data through AI systems, boards should understand how information is protected and whether data governance practices meet regulatory requirements.

The key oversight question: Does operational AI help the sub-adviser focus on its primary mandate, or does it create complexity that might distract from core responsibilities to the fund?

When AI Enters Investment Processes

Some sub-advisers integrate AI directly into investment processes, including model development, alternative data analysis, portfolio construction, and risk management.

This integration may require boards to revisit questions from the original sub-advisory due diligence. When the principal adviser first recommended this sub-adviser, what specific expertise was being accessed? If that expertise is now supplemented or replaced by AI capabilities, does the original rationale still hold?

Potential Conflicts of Interest

AI can introduce conflicts that traditional oversight frameworks might not catch. When sub-advisers develop proprietary AI capabilities, cost allocation becomes relevant - who bears development costs versus who benefits? If fund fees help finance AI development that primarily enhances the sub-adviser's competitive position, this could create a conflict.

Data usage presents another consideration. Sub-advisers may use trading data or portfolio insights from managing the fund to train AI models that later benefit other clients or proprietary strategies.

The key evaluation: Is AI enhancing the specific investment expertise originally engaged, or has it changed the investment approach in ways that affect the fund?

For the complete analysis, including detailed oversight frameworks and additional real-world examples, please visit the full article on Fund Board Views. Thank you for your support.

Thanks for reading. I hope you have a fantastic June.

Joyce